views

The India Agrochemical Market is valued at USD 10.5 billion, witnessing consistent growth due to rising food demand, government-backed initiatives, and the urgent need to improve crop productivity. With agriculture accounting for over 42% of India’s workforce, agrochemicals like pesticides, herbicides, fungicides, and fertilizers have become critical in securing food supply and enhancing yield quality. Additionally, emerging trends in sustainable farming and precision agriculture are reshaping the landscape, making this sector one of the most dynamic within India’s agribusiness economy.

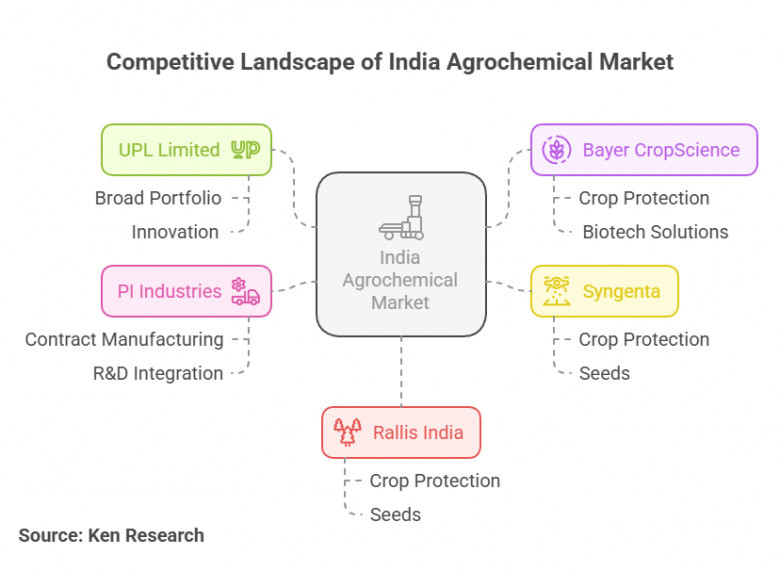

Top Players in the India Agrochemical Market

The competitive landscape of the Indian agrochemical industry is dominated by a mix of multinational corporations and strong local players, each leveraging their R&D capabilities and distribution strength:

-

UPL Limited (India): Known for its broad agrochemical portfolio, UPL continues to lead through innovation and exports.

-

Bayer CropScience (Germany): With a strong foothold in crop protection, Bayer focuses on biotech-driven solutions tailored to Indian farming needs.

-

Syngenta (Switzerland): A key player in crop protection and seeds, it invests heavily in digital farming technologies.

-

PI Industries (India): Specializes in contract manufacturing and exports, with deep R&D integration for custom synthesis.

-

Rallis India (Tata Group): Offers a broad range of agri-inputs including crop protection and seeds, focusing on sustainable agriculture practices.

These companies are advancing through partnerships, sustainability initiatives, and expansion into new agrochemical categories such as bio-pesticides, which are seeing rapid growth in India’s organic farming sector.

Access a preview of key trends, segmentation, and future outlook in this detailed India Agrochemical Market Sample Report to explore how your business can grow with India’s agricultural boom.

Key Challenges Facing the Market

While the market shows promising growth, several challenges need to be addressed:

-

Environmental Concerns: Overuse of agrochemicals has led to soil degradation, water pollution, and biodiversity loss, prompting stricter government regulations.

-

High Input Costs: Advanced agrochemicals, especially eco-friendly formulations, remain expensive. Small and marginal farmers, who make up a significant part of India's agricultural workforce, often find them unaffordable.

-

Supply Chain Gaps: Dependency on imported raw materials like technical-grade ingredients exposes the market to global price volatility and supply disruptions.

-

Resistance Development: Continuous use of certain pesticides has led to increased pest resistance, necessitating new molecule development, which is time-consuming and capital intensive.

Compare India's growth with the North America Agrochemical Market or discover sustainable farming shifts in the US Bio-pesticides Market Growth to understand global dynamics.

Emerging Opportunities

Despite the challenges, several trends are creating strong growth opportunities for stakeholders:

1. Shift Toward Sustainable Solutions

Government schemes and changing consumer preferences are driving demand for bio-pesticides and organic farming inputs. With nearly 2 million hectares under organic cultivation, this segment presents a high-growth avenue.

2. Expansion in Underpenetrated States

States like Assam, Odisha, and Madhya Pradesh are investing in agricultural modernization. These emerging markets offer potential for customized agrochemical solutions catering to regional crop patterns.

3. Rise of Precision Agriculture

Technology-driven farming practices are enabling precision agrochemical application, which reduces waste and boosts ROI. The adoption of drones, AI, and soil analytics tools creates demand for tailored crop protection strategies.

4. Export Growth

India exported USD 5.5 billion worth of agrochemicals in FY 2022-23, with further export promotion supported by the Agricultural Export Policy. This opens avenues for manufacturers aiming to meet international safety and environmental standards.

Get the Latest Data on USA Fertilizer Market Trends – including nutrient usage, pricing, and demand analysis.

Conclusion

The India agrochemical industry is entering a transformative phase, with digital agriculture, sustainability, and localized innovations setting the tone for the future. While environmental and affordability concerns persist, proactive steps by government bodies and industry leaders are paving the way for a more resilient and efficient ecosystem. Stakeholders who invest in bio-based innovations, expand in underserved markets, and align with smart farming trends will be well-positioned to thrive in this evolving landscape.

You can also read about: The APAC Fuel Cell Balance of Plant Market Growth and Top Players

Comments

0 comment