views

The North America Agricultural Tractors Market stands strong with a valuation of USD 15.5 billion in 2023, and is poised for robust growth. The rapid transformation of agriculture—driven by technological innovation, precision farming, and sustainability goals—is fueling unprecedented demand for tractors across the United States and Canada.

As farmlands expand and agriculture becomes more data-driven, tractors are no longer seen as simple machinery but as smart, connected assets that help optimize farming practices and reduce operational costs.

Moreover, government support, climate-resilient farming initiatives, and rising labor shortages are accelerating the mechanization trend, reshaping the future of North American agriculture.

For a broader view on agriculture and farm technologies, you may also explore the North America Agrochemical Market Growth and Global Terminal Tractor Market Opportunities.

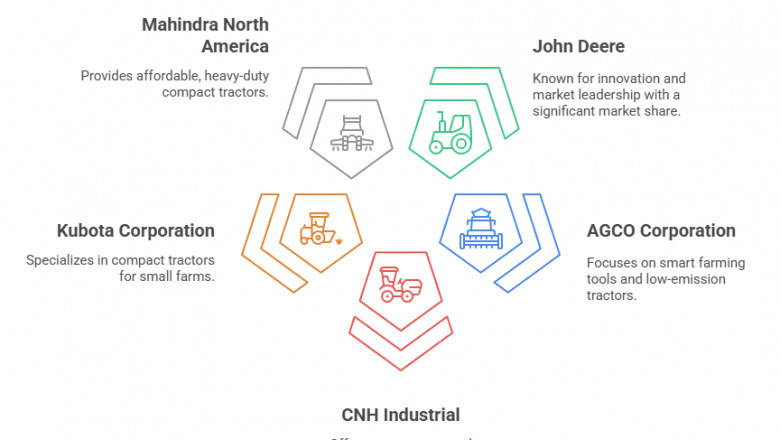

Top Players Leading the North America Agricultural Tractors Industry

Several major players dominate the North America Agricultural Tractors Market through constant innovation, smart technology integration, and strong after-sales services:

-

John Deere (Deere & Company)

-

Founded: 1837

-

HQ: Illinois, USA

-

2023 Revenue: USD 61.3 billion (global)

-

Key Innovations: Autonomy kits, electric tractors, precision farming systems (Operations Center™).

-

John Deere dominates with over 25% market share in North America.

-

-

AGCO Corporation (Brands: Massey Ferguson, Fendt, Challenger)

-

Founded: 1990

-

HQ: Georgia, USA

-

2023 Revenue: USD 14.4 billion

-

Focus: Smart farming tools like Fuse®, and low-emission tractors.

-

-

CNH Industrial (Case IH, New Holland)

-

Founded: 2013 (merger)

-

HQ: London, UK / Illinois, USA (operations)

-

2023 Revenue: USD 23 billion

-

Key Offerings: Autonomous tractors, methane-powered models.

-

-

Kubota Corporation

-

Founded: 1890

-

HQ: Osaka, Japan

-

Strength: Compact tractors (<40 HP), growing North American market share, especially among small farms.

-

-

Mahindra North America

-

Founded: 1945 (Parent)

-

HQ: Texas, USA

-

Focus: Affordable, heavy-duty compact tractors, serving both hobbyists and small commercial farms.

-

Challenges Impacting the Market

While growth opportunities are strong, a few challenges continue to affect market dynamics:

-

High Capital Investment for Advanced Machinery:

Advanced tractors equipped with GPS, IoT, AI, and hybrid engines cost significantly more.-

Example: A new John Deere autonomous tractor can cost between USD 500,000–USD 700,000, making it unaffordable for small farmers without subsidies or financing.

-

-

Regulatory Compliance Costs:

Strict Tier 4 Final emission norms by the U.S. EPA and Environment Canada's regulations are forcing manufacturers to develop cleaner engines, adding 15–20% extra production costs. Farmers bear some of these expenses through higher retail prices. -

Labor Shortages and Skill Gaps:

As tractors become smarter, operating them also demands higher technical knowledge.-

Finding: According to the Association of Equipment Manufacturers (AEM), over 40% of farmers feel "somewhat unprepared" to operate fully autonomous tractors.

-

Opportunities Reshaping the Future

-

Electrification of Tractors:

North America is moving toward electric and hybrid agricultural machinery.-

Forecast: The market for electric tractors is expected to grow at a CAGR of 8.6% between 2024 and 2028.

-

Key Initiatives: California’s CORE program offers incentives up to USD 500,000 per electric tractor purchase.

-

-

Expansion of Precision Agriculture:

Integration of sensors, telematics, and satellite-guided equipment is becoming mainstream.-

Farmers using precision agriculture techniques report up to 15% yield improvements while reducing fertilizer and pesticide usage by 20–30%.

-

This opens doors for high-tech tractors equipped with real-time monitoring, variable rate technology (VRT), and machine learning capabilities.

-

For insights into how chemicals support precision farming, read the India Agrochemical Market Analysis.

Conclusion: Towards Smarter, Greener Farms

The North America Agricultural Tractors Industry is gearing up for a future marked by automation, sustainability, and smart farming ecosystems.

Although high costs and regulatory pressures present barriers, the momentum towards electrification, precision farming, and autonomous operations is strong.

Manufacturers focusing on affordable smart solutions and governments supporting clean technology adoption will likely dominate the next growth phase. The tractor, once a symbol of mechanical farming, is now evolving into the brain of the future farm.

You can also read about: The Industry Analysis of Respiratory Monitoring Devices Market Segmentation and Trends

Comments

0 comment