views

Cut Costs and Errors Using Financial Spreading Automation

Is your team spending countless hours inputting financial data manually—only to catch critical errors too late? If so, you’re not alone. Traditional financial analysis workflows rely on human input, spreadsheets, and manual cross-checking. However, with growing volumes of financial documents and increasing demand for speed and accuracy, these outdated processes no longer cut it.

This blog explores how financial spreading automation helps reduce operational costs and eliminates costly data errors. We’ll break down the key challenges of manual financial spreading, the advantages of automation, and the measurable outcomes businesses can expect by making the switch.

The Problem with Manual Financial Spreading

Manual financial spreading involves reviewing balance sheets, income statements, and cash flow reports—often from PDFs or scanned documents—and manually transferring that data into spreadsheets or analysis platforms. This process is time-consuming, repetitive, and prone to human error.

Even the most experienced analysts can miss a decimal, misinterpret a note, or misplace a value. These small mistakes lead to flawed reports, bad credit decisions, and delays in processing. Manual methods also slow down deal pipelines, making it harder to respond to real-time market shifts.

That’s where financial spreading automation steps in.

What Is Financial Spreading Automation?

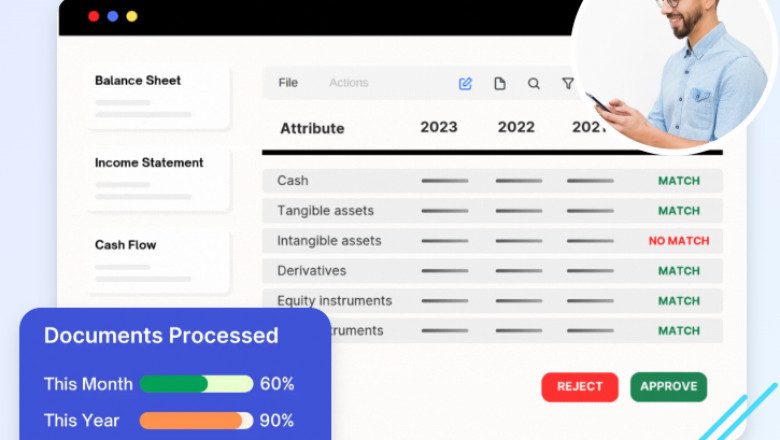

Financial spreading automation uses AI-driven tools and machine learning to extract, classify, and standardize financial data from various document types—whether structured or unstructured. This includes scanned PDFs, bank statements, tax returns, and multilingual reports.

Once extracted, the data is automatically normalized, reconciled across statements, and integrated into reporting systems. The result is cleaner, faster data that drives more accurate credit, equity, and performance analyses.

This technology replaces tedious, error-prone tasks with efficient, intelligent workflows that scale.

Reduce Human Error at Every Step

One of the biggest value drivers in financial spreading automation is error reduction. Mistakes in financial data—whether from misreading numbers or manual typos—can lead to incorrect credit scores, bad investment recommendations, or compliance risks.

Automation tools apply consistent logic across every data point, flag anomalies, and validate totals between statements and supporting notes. This drastically reduces the chances of a discrepancy between balance sheets, income reports, and cash flow statements.

Removing the human variable from repetitive tasks increases reliability and frees analysts to focus on insights rather than data entry.

Cut Labor Costs and Time-to-Insight

Traditional financial spreading is resource-heavy. Analysts may spend hours—sometimes days—extracting and inputting financial information for a single client. Multiply that by dozens or hundreds of clients, and the labor costs increase quickly.

Data extraction, reconciliation, and formatting are done in minutes with financial spreading automation. This slashes turnaround times, lowers personnel costs, and accelerates the delivery of financial insights.

Faster analysis means lenders, underwriters, and portfolio managers can act sooner—approving a loan, assessing creditworthiness, or evaluating deal risk.

Improve Compliance and Audit-Readiness

In regulated industries, documenting the financial analysis process is critical. Regulators and auditors often require full visibility into how figures were obtained, calculated, and interpreted.

Financial spreading automation ensures every action—every data extraction, transformation, and output—is logged and traceable. These tools provide digital audit trails that are far more reliable than scattered spreadsheets or handwritten notes.

Built-in compliance features also support standardized financial formats and reporting guidelines, reducing non-compliance risk across regions and industries.

Increase Team Productivity and Scalability

As financial institutions grow, so does the volume of data. Hiring more analysts isn’t always feasible. Instead, automation helps teams do more with the resources they already have.

With financial spreading automation, junior staff can handle more accounts without sacrificing accuracy, and senior analysts can devote more time to strategic evaluations. The entire team becomes more agile, capable of taking on higher volumes or expanding into new markets without operational strain.

This scalability is essential for firms looking to grow without ballooning headcount or overhead.

Enhance Decision-Making with Real-Time Accuracy

Outdated information leads to poor decisions. Whether it’s an investment strategy or a lending decision, timing matters. Financial spreading automation ensures that financial data is processed in near real-time, providing analysts and decision-makers with up-to-date, accurate numbers.

This rapid turnaround is especially valuable during quarterly reviews, end-of-year audits, or merger and acquisition activity—when fast, informed decisions make all the difference.

Automation eliminates data delays and empowers businesses to act with confidence and agility.

Easy Integration with Existing Systems

Modern automation tools are designed to fit into your current tech stack. From enterprise resource planning (ERP) platforms to credit risk systems and business intelligence dashboards, financial spreading solutions can be plugged in through APIs and connectors.

This makes it easy to automate without disrupting your current workflows. The seamless data flow from input to output allows departments to collaborate better and avoid redundant processes.

This interoperability further reduces costs by eliminating software silos and manual rekeying between systems.

Conclusion

As financial data becomes more complex and decisions need to happen faster, manual methods can no longer keep up. Financial spreading automation reduces costly errors and slashes operational expenses, boosts productivity, and improves the speed and quality of financial insights.

From credit risk analysis to equity research and financial reporting, the benefits are clear: faster, more accurate data at a fraction of the cost.

Now is the time to modernize your approach because precision and speed are everything in finance.

Comments

0 comment