views

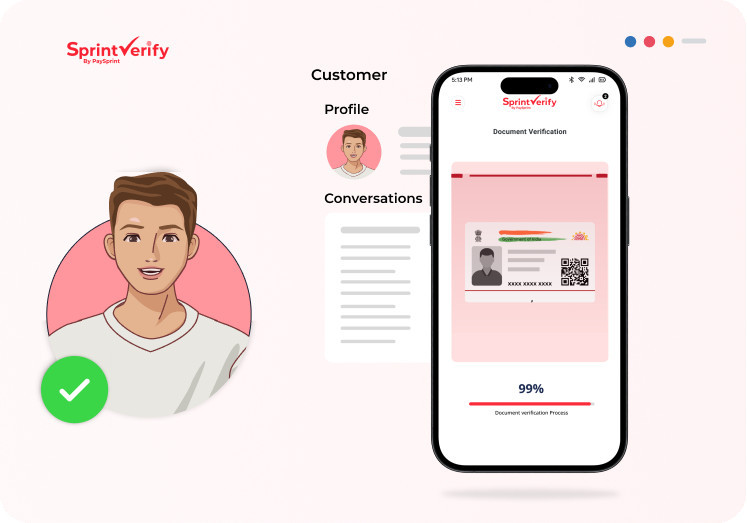

Simplify Merchant Onboarding with SprintVerify: Boost Growth and Reduce Risk

Merchant onboarding is a critical part of building any online platform today, whether you're running a marketplace, an aggregator, or a financial services platform. But traditional onboarding processes can be slow, inefficient, and filled with manual errors. This is where SprintVerify transforms the experience.

SprintVerify offers a cutting-edge Merchant Onboarding solution that automates critical checks like GST Verification, PAN Validation, Business Bank Account Verification, and Director Identity Verification. Instead of waiting days or weeks to approve a merchant, businesses can now complete the verification process in a matter of minutes.

By ensuring compliance and eliminating fraud risks early, SprintVerify helps organizations scale faster and build trust with their network of merchants. Whether you're onboarding hundreds or thousands of vendors, SprintVerify's robust platform ensures smooth, secure, and efficient operations.

If you’re serious about growing a reliable merchant base and maintaining compliance, explore how SprintVerify can supercharge your onboarding process today.

Comments

0 comment