views

Customs clearance can often seem daunting, but understanding section 321 offers practical solutions for certain shipments. Section 321 customs clearance allows for the duty-free importation of goods valued at $800 or less, streamlining the process for low-value shipments. This provision is particularly beneficial for e-commerce businesses and small retailers, making it easier for them to import products without incurring significant costs.

Navigating the complexities of customs can hinder timely deliveries. With section 321, importers can bypass traditional duties and expedite their packages through an efficient clearance process. This not only reduces costs but also enhances the overall efficiency of the supply chain.

As businesses adapt to global commerce, knowing how to effectively use customs clearance solutions is essential. The strategies surrounding section 321 create opportunities for growth and increased competitiveness in the market. Understanding these solutions is the first step for businesses looking to optimize their import processes.

Understanding Section 321 Customs Clearance

Section 321 provides a streamlined process for the clearance of certain low-value shipments, allowing for quicker arrivals of goods into the United States. This section is beneficial for businesses engaged in international trade, as it reduces customs barriers and fosters efficiency.

Overview of Section 321

Section 321 of the Tariff Act enables the duty-free importation of goods valued at $800 or less. This regulation is particularly useful for e-commerce businesses and small importers. Under this provision, eligible shipments can be exempt from standard customs duties, expediting their entry into the U.S.

This process simplifies customs clearance and minimizes the paperwork required for low-value items. It effectively promotes trade by reducing costs and delays for importers. When used appropriately, Section 321 can enhance the speed of supply chains and improve customer satisfaction.

Benefits of Section 321 Clearance

The primary benefit of Section 321 is its cost-effectiveness. Businesses can save on duties for low-value shipments, allowing for improved pricing strategies. This enables small businesses or startups to remain competitive in the global market.

Additionally, Section 321 expedites the delivery process. Importers can experience faster customs processing times, with many packages cleared within hours rather than days. This swift process can significantly enhance inventory management and order fulfillment.

Using this clearance option also simplifies compliance for businesses. Given the lower threshold for documentation, companies can reduce their administrative burden. This can lead to streamlined operations and better allocation of resources.

Eligibility Criteria for Section 321 Entry

To qualify for Section 321 clearance, shipments must meet specific criteria. The primary requirement is that the total value of the goods must not exceed $800, including shipping costs.

Another criterion includes the shipment's intended use; items must not be intended for resale. Also, a shipment can only qualify for one Section 321 entry per day, which prevents multiple low-value shipments from being combined to exceed the value limit.

Importers should also ensure that their shipments are from authorized sources and comply with all import regulations. Meeting these eligibility criteria is essential for smooth processing under Section 321.

Implementing Customs Clearance Solutions

Effective implementation of customs clearance solutions involves integrating technology, strategic planning, and ensuring compliance with regulations. Focusing on these areas can streamline processes and enhance efficiency.

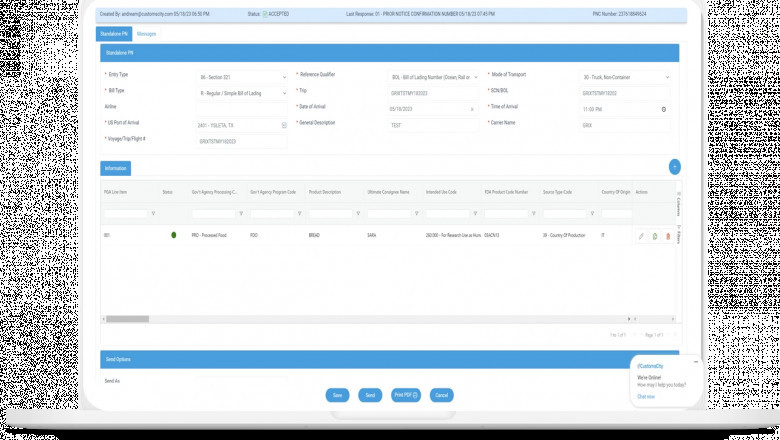

Technological Advancements in Customs Clearance

Advancements in technology play a crucial role in customs clearance. Automation tools, such as electronic data interchange (EDI), facilitate faster communication between importers, exporters, and customs authorities.

Key technologies include:

- Blockchain: Enhances transparency and traceability.

- AI and Machine Learning: Improve risk assessment and predictive analytics.

- Cloud-based Systems: Enable real-time access to information.

These tools minimize errors, reduce processing times, and streamline documentation. Investing in technology also ensures more robust data security in an increasingly digital environment.

Strategic Planning for Efficient Clearance

Strategic planning is essential for optimizing customs clearance processes. Companies must evaluate their supply chain logistics to identify potential bottlenecks.

Elements of effective strategic planning include:

- Pre-Planning: Determine required documentation early.

- Collaboration: Work closely with freight forwarders and customs brokers.

- Training: Educate staff on customs regulations and processes.

Having a well-defined plan allows companies to tackle issues proactively, thus reducing delays and costs associated with customs clearance.

Compliance with Customs Regulations

Compliance with customs regulations is non-negotiable for successful clearance. Adhering to local and international laws helps avoid penalties and shipment delays.

Key compliance measures include:

- Regular Audits: Conduct internal audits to ensure adherence to regulations.

- Customs Broker Utilization: Engage qualified brokers for expert guidance.

- Stay Updated: Monitor changes in customs laws and procedures.

By prioritizing compliance, organizations can safeguard their shipments and maintain smooth operations throughout the clearance process.

Comments

0 comment